Please update your browser.

Findings

- Go to finding 12013年至2018年期间,收入波动性保持相对稳定. 波动中值水平的股票, on average, 在前一年,每个月的收入变化是36%.

- Go to finding 2家庭经历的收入波动程度有很大差异, 既包括特定时间点的家庭也包括特定时间点的家庭.

- Go to finding 3On average, families experience large income swings, in almost five months out of a year. 收入飙升的可能性是收入下降的两倍,在3月和12月最常见. Families with the most volatile incomes experience swings that are larger but not more frequent than families with less volatile incomes.

- Go to finding 4年轻人和高收入人群的收入波动最大. However, downside risks, 以收入下降的幅度和频率来衡量, 是低收入家庭中最大的吗.

- Go to finding 52013年至2018年期间,支出波动趋势持平. 而支出波动的水平也很高, 这比收入波动率低15%, except among account holders over the age of 75 and those with the largest cash buffers.

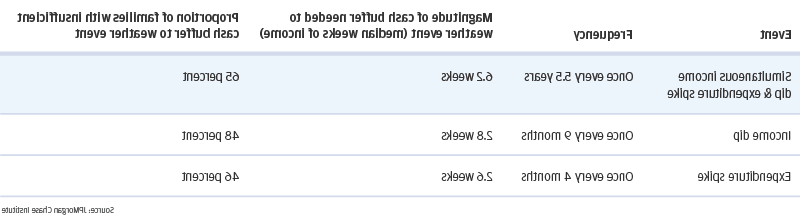

- Go to finding 6Families need roughly six weeks of take-home income in liquid assets to weather a simultaneous income dip and expenditure spike. 65%的家庭没有足够的现金缓冲来做到这一点.

Download

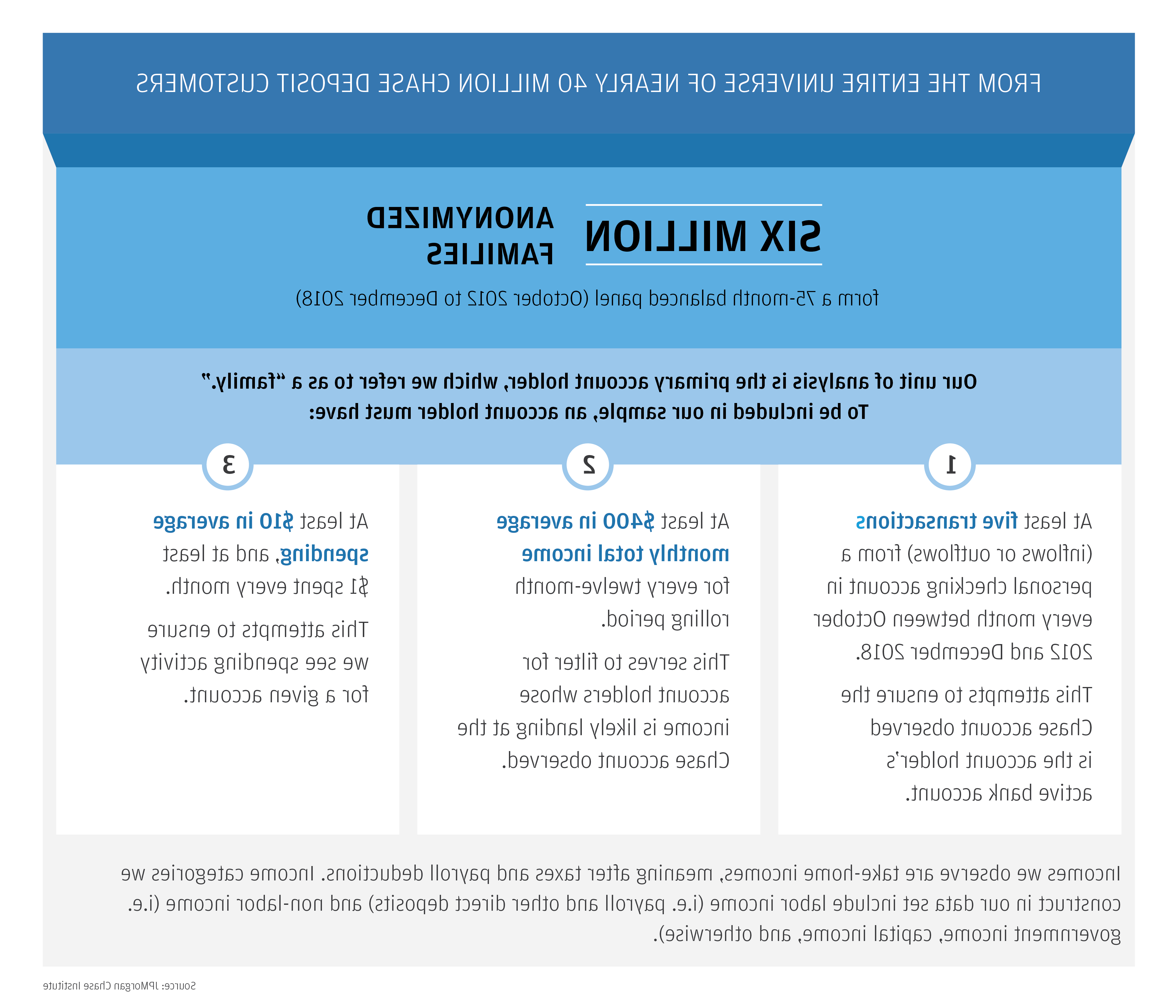

In this report, the JPMorgan Chase Institute uses administrative bank account data to measure income and spending volatility and the minimum levels of cash buffer families need to weather adverse income and spending shocks.

Inconsistent or unpredictable swings in families’ income and expenses make it difficult to plan spending, pay down debt, 或者决定存多少钱. Managing these swings, or volatility, is increasingly acknowledged as an important component of American families’ financial security. 在之前的澳博官方网站app研究所(JPMCI)研究中, we have documented the high levels of income and expense volatility families experience. In this report, we make further progress toward understanding how volatility affects families and what levels of cash buffer they need to weather adverse income and spending shocks. 我们探讨了六个关键问题:

- 2013年至2018年的逐月收入波动趋势如何?

- 收入波动的分布是怎样的?它是否每年都持续存在?

- 收入飙升与下降的普遍性和程度如何?

- 不同人口群体的收入波动有何不同?

- 与收入波动相比,每月支出波动如何, 总体和跨人口群体?

- What are the minimum levels of cash buffer that families need to weather adverse income and spending shocks?

Finding Three: On average, families experience large income swings, in almost five months out of a year. 收入飙升的可能性是收入下降的两倍,在3月和12月最常见. Families with the most volatile incomes experience swings that are larger but not more frequent than families with less volatile incomes.

Finding Five: 2013年至2018年期间,支出波动趋势持平. 而支出波动的水平也很高, 这比收入波动率低15%, except among account holders over the age of 75 and those with the largest cash buffers.

Our findings have important implications for designing savings strategies to improve families’ financial health and resilience. They suggest that the tools currently available to help families weather volatile income and spending could be better tailored to an individual’s cash flows. Simply saving a certain percentage of monthly income may leave a family with an inadequate cash buffer, exacerbating financial distress in cash flow negative months and resulting in under-saving during cash flow positive months. Instead, families may need to more aggressively harvest savings opportunities during income spike months. 我们为家庭提供经验指导, financial health advocates, financial advisors, and policymakers on the minimum levels of cash buffer families need to weather adverse shocks. 鉴于稳定对家庭财务生活的健康起着关键作用, it is critical that we continue to gauge how income and spending volatility are changing for American families and the implications for families’ financial health.